Decoding the state of the Indian economy amidst COVID-19 disruptions

15 Jul 2020

The coronavirus outbreak has severely impacted the economic activities in India, as the lockdown has halted the growth

trajectory. Though some of the restrictions are being gradually eased, still many major cities are facing a tough

challenge. The global financial crisis of 2008-09, and the COVID-19 pandemic of 2020, has rocked the financial

system just within a decade, and the current turmoil, in all probability, will have a long-term impact on the

Indian economy.

The RBI Governor has said this week that the pandemic might lead to higher NPAs; banks need additional capital buffer

against shocks. Some major global credit rating agencies, such as Fitch Ratings, S&P Global Ratings, and Moody's have

trimmed their sovereign ratings for India to the lowest investment grade. The Finance Ministry expects the Gross

Domestic Product (GDP) growth to contract to 4.5% in the financial year 2020-21, in line with the global growth

slowdown. This projection is 6.4 percentage points lower against April '20 estimates.

Although the Indian government has made some breakthroughs in tax reforms, and other areas, the economic growth has

not reached the desired levels before the pandemic. An outbreak of coronavirus has further worsened the sentiments.

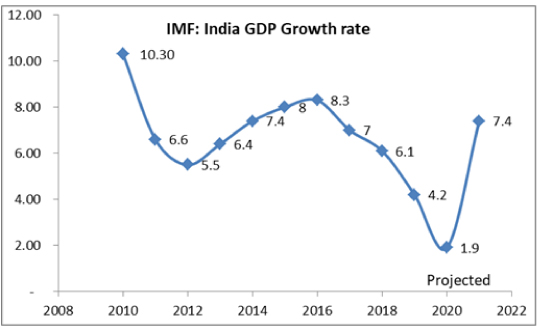

Since 2016, India's growth rate has declined steadily.

According to the International Monetary Fund (IMF) forecast for June, the Indian economy is set to contract by 4.5 per cent

in 2020 following a long period of lockdown, and slower recovery. The IMF's latest forecast for India is in line with other

estimates that project Asia's third-largest economy to contract between 4 per cent and 5 per cent in 2020. First-quarter

GDP was generally worse than expected (the few exceptions include, for example, Chile, China, India, Malaysia, and Thailand,

among emerging markets, and Australia, Germany, and Japan, among advanced economies). High-frequency indicators point to

a more severe contraction in the second quarter, except in China, where most of the country had re-opened by early April.

In January 2020, it cut the projected growth rate for 2019 (FY20) from 6.1 per cent to 4.8 per cent, citing slowing domestic

demand, and a stressed non-banking financial sector. The IMF has repeatedly pointed to demonetization and glitch-ridden GST

reforms, as two of the many reasons for the abrupt economic slowdown in India.

If we closely track the government’s revenue receipts, it registered a negative growth of 68.9 per cent, led by negative growth in personal income tax, all indirect taxes, and non-tax revenues. Non-Tax revenues, up to May 2020, turned out to be less than 62 per cent of the levels till May 2019. On the expenditure side, the capital expenditure rose by 15.7 per cent relative to May last year. In contrast, revenue expenditure fell 1.9 per cent over May 2019, and stood at 17.4 per cent of budget estimates.

The Centre’s gross market borrowings up to 19th June stood at Rs. 2,82,000 crores, 51 per cent higher than last year — net borrowings were 12.3 per cent higher. Even the states too continued borrowing. Despite so much negativity in the recent past, there are some green shoots, which are clearly visible, indicating that the economy could recover faster than anticipated. India has the potential to beat other emerging markets, in case the coronavirus tragedy passes soon. The Finance Ministry’s monthly macro-economic report for May and June are indicating a recovery in economic activity in many fields. Improvement is visible in segments, such as electricity fuel consumption, inter and intra-state movement of goods, and retail financial transactions pick-up.

Let us elaborate in detail, as to which sectors are showing some progress-

Electricity consumption saw a lower contraction in growth rates — from (-) 24 per cent in April, to (-) 15.2 per cent in May, to (-) 11.3 per cent in June (till June 28).

The total assessable value of E-Way bills rose 130 per cent in May 2020 (Rs. 8.98 lakh crores) compared to April 2020 (Rs. 3.9 lakh crores), though still below pre-lockdown levels. The value of E-Way bills generated between June 1 and 28 stood at Rs. 11.4 lakh crores.

Petroleum consumption has increased by 47 per cent in May compared to April, and the year-on-year contraction was much smaller at (-) 23.2 per cent in May, as against (-) 45.7 per cent in April.

Average daily electronic toll collections increased from Rs. 8.25 crores in April to Rs. 36.84 crores in May, rising more than four times. In the first four weeks of June, it has improved further to Rs. 50.9 crores.

Total digital retail financial transactions via NPCI platforms increased sharply from Rs. 6.71 lakh crores in April to Rs. 9.65 lakh crores in May. A similar trend could continue in June as well.

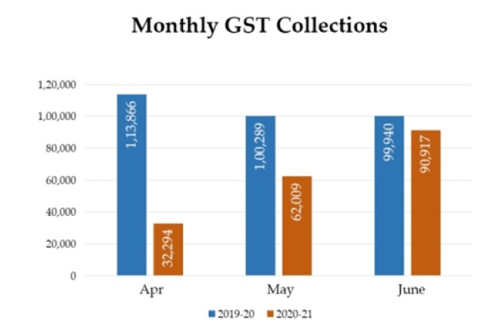

Other than this, some significant movement is also seen in areas such as railway freight, improvement in Purchasing Managers’ indices, and the rebound in Goods and Services Tax collections. The GST collected for June, amounted to ₹ 90,917 crores (CGST- ₹ 18,980 crores, SGST- ₹ 23,970 crores, IGST- ₹ 40,302 crores, and Cess- ₹ 7,665 crores). The departments have already settled ₹ 13,325 crores to CGST, and ₹ 11,117 crores to SGST from the IGST collections. The total revenues of the State and the Central governments are ₹ 32,305 crores for the CGST, and ₹ 35,087 crores for the SGST. Although these figures are less than the previous financial year, yet the revenues for the month of June are 91% of the GST revenues in the same month last year.

One more sector is seeing positive signals in rural India. With the reverse migration, hopes of a good monsoon, along with increased government expenditure through MNREGA and other public projects, are likely to ensure increased demand from rural India. FMCG companies are witnessing strong growth in rural India, which is outpacing urban growth. Rural has already reached 85% of pre-COVID average sales, while urban market sales were relatively lower at 70% in May, according to Nielsen’s latest data. June has seen extraordinarily good demand in rural areas, and the extension of MNREGA has undoubtedly aided the strong demand.

Foreign investors are keenly looking towards India to invest. Google has said that it plans to invest Rs. 75,200 crores in India in the coming years, including infrastructure and equity investments. Recently, Reliance Jio has raised a total of ₹1.18 Lakh crores from leading technology investors, including Facebook, Silver Lake Partners (two investments), Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, PIF, and Intel Capital. We can expect the Indian economy to see a decent recovery in the coming quarters once the coronavirus tragedy cools off.